The Enhanced Housing Grant (EHG) in Singapore is a government housing subsidy aimed at providing financial assistance to eligible individuals and families to help them afford the purchase of their first home. The Enhanced Housing Grant was introduced as part of the broader housing policies in Singapore to make homeownership more accessible, particularly for lower- and middle-income households.

Key features of the Enhanced Housing Grant include:

- Eligibility Criteria: The grant is typically available to first-time homebuyers who meet specific income and other eligibility criteria. The eligibility criteria may vary based on the type of housing, such as resale flats, Build-to-Order (BTO) flats, or Executive Condominiums (ECs).

- Income Ceiling: The grant considers the household income of the applicants, and there is an income ceiling to determine eligibility. The income ceiling may be adjusted based on the type of housing and the number of applicants.

- Grant Amount: The Enhanced Housing Grant provides a substantial amount of financial assistance. The grant amount is determined based on the applicant’s average gross monthly household income and the type of housing chosen.

- Flat Type and Location: The grant amount may vary depending on the flat type (e.g., 2-room, 3-room, 4-room) and the location of the housing unit. Higher grants are generally provided for those purchasing smaller flats in non-mature estates.

- Application Process: Eligible individuals can apply for the Enhanced Housing Grant when they apply for a flat from the Housing and Development Board (HDB). The grant is typically factored into the overall housing loan amount, reducing the financial burden on the homebuyer.

How much EHG am I eligible for?

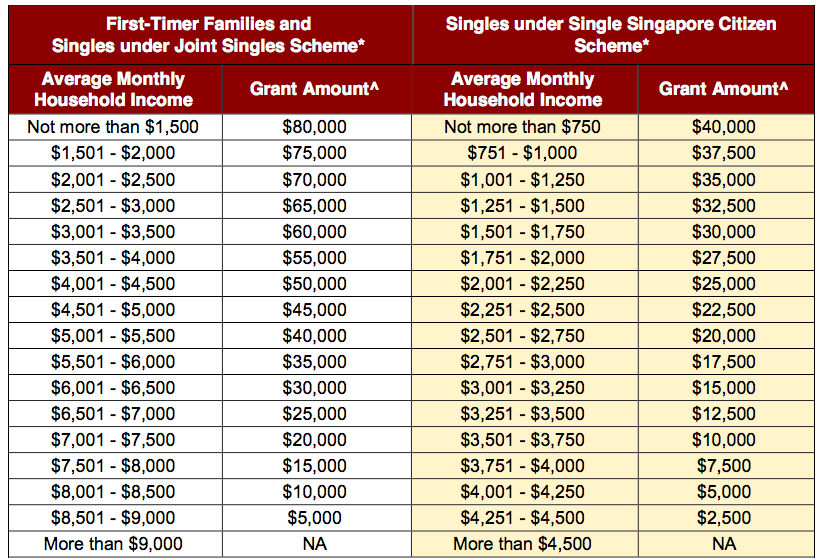

Eligible first-timer applicants for new flats can enjoy an EHG of up to $80,000, while eligible first-timer singles can enjoy an EHG (Singles) of up to $40,000.

Similarly, eligible first-timer households buying a resale flat can also enjoy an EHG of up to $80,000, in addition to the CPF Housing Grant (up to $80,000) and Proximity Housing Grant (up to $30,000). This means that first-time resale homebuyers can enjoy up to $190,000 in housing grants!

How does EHG work?

To qualify for EHG, the monthly household income for first-timer families should not exceed $9,000 (refer to Table 1 below). Eligible first-timer singles must be aged 35 and above, with a monthly income of less than $4,500. In both cases, the buyer or his/ her spouse must be in continuous employment for the 12 months prior to the date of flat application and remain working at the point of flat application.

Table 1: EHG Structure

*The EHG is applicable for those buying 2-room Flexi flats on 99-year leases in the non-mature estates, 2-room Flexi flats on short leases, and resale flats (up to 5-room under the Single Singapore Citizen Scheme, and all flat types under the Joint Single Scheme).

^The EHG amount is applicable to households buying a flat with a remaining lease that can cover the buyers and their spouses to the age of 95; otherwise, the household will enjoy a pro-rated EHG.

What happens if the remaining lease of the flat I buy does not cover the youngest owner till the age of 95?

To enjoy the full EHG amount for the relevant income brackets, the purchased flat must have sufficient lease to cover the buyers and their spouses to the age of 95. Otherwise, the amount of grant will be pro-rated. This condition also applies to repurchased flats under the Sales of Balance Flats or Re-Offer of Flats exercises.

For example, a couple, both aged 30, with an average monthly household income of $4,800, has purchased a resale flat with a remaining lease of 60 years. As the flat cannot cover them to the age of 95, they can enjoy an EHG of $40,000 as opposed to the full EHG amount of $45,000 for their income bracket.

it is recommended to check with the Housing and Development Board (HDB) or relevant government agencies, or consult their official website for the latest guidelines and eligibility criteria.